Chapter 2 Intellectual Property Rights

Intellectual property law is one of the main policy instruments used to guide the impact and direction of innovation efforts. Formally, its goal is to encourage innovation and creation of intellectual goods by facilitating the innovators’ appropriation of the derived benefits. Following the rise in the rate of innovation that marked the 21st century, further enhanced by the digital revolution, IPRs have been increasingly contested by different stakeholders. IPRs incentivize or deter specific innovative behaviors, playing a fundamental normative function in determining the rate and trajectory of innovation efforts.

First, I will present the foundations of IPRs, starting from the philosophical and economic justification for creating a property right in intangibles. Second, I will present some of the IPRs involved in Artificial Intelligence, focusing on the economics of patents and presenting the legal framework surrounding copyright and the database sui-generis right. Finally, I will examine whether the claims regarding the potential introduction of new IPRs to AI technologies are justified from an economic perspective.

2.1 Foundations of Intellectual Property

Spence (2007) defined intellectual property rights as a “right that can be treated as property to control particular uses of a specified type of intangible asset”, suggesting IPRs protection covers only specific kinds and uses of intangible assets. In other words, the property right does not directly involve the intangible asset but rather the right to exclude others to make specific uses of it.

2.1.1 Justifications for the existence of intellectual property rights

A complete review of the philosophical and economic justifications of existence of IPRs would go well beyond the scope of this dissertation, thus I will focus on the three most common explanations: the natural rights argument, the desert argument, and the utilitarian argument, which has traditionally been the most influential in constructing a legal framework for IP.13

2.1.1.1 The natural rights argument

The natural rights argument, first expressed by John Locke in the Second Treatise of Government (1689), is based on the assumption that people are naturally entitled to the fruits of their labor, including the fruits of their intelligence. He affirmed that: "The labour of his body and the work of his hands, we may say, are strictly his. So when he takes something from the state that nature has provided and left it in, he mixes his labour with it, thus joining to it something that is his own; and in that way he makes it his property" (Locke 1689). However, this approach to IPRs cannot be considered valid on at least two different basis. First, it justifies control over the elements of an intangible asset for which a creator is responsible. However, intangible assets are very problematic because it is impossible to determine which assets the creator is genuinely accountable for. Nozick (1974) presented a counterargument by comparing newly produced knowledge to tomato sauce spilled in the ocean. If somebody owns the tomato sauce (the intellectual labor) and drops it into the sea (the entire global knowledge), is it right for him to claim the ocean as a whole as his? Locke (1689) himself provided the second objection to the natural right argument. He assumed that this appropriation system could be applied only when appropriation does not leave anybody else worse off, which is not always the case. Even when a creator can claim a specific asset’s origin, he is not necessarily entitled to control its use. Imposing a normative claim would preclude the user’s autonomy and, therefore, make him worse off, invalidating the appropriation process.

2.1.1.2 The desert argument

Another commonly used justification of IPRs is that an intangible asset’s creator deserves to benefit from his labor. This is generally referred to as the desert argument. On the other hand, this argument does not consider that property rights are not the only way to reward a creator. As Hettinger (1989) points out, laborers may perform intellectual work only for the end of performing it, such as genuine interest in that field of knowledge, society’s progress, ethical reasons, and so on so forth. In those cases, other possible rewards are recognition, gratitude, or public financial support to continue pursuing their work. IPRs are only one of several possible means to provide incentives to intellectual laborers, and exclusive property rights may impose an unnecessary cost to society.

2.1.1.3 The utilitarian argument

The utilitarian approach is the one that has historically prevailed, and most contemporary legal and economic arguments regarding IPRs are based on this paradigm. Unlike other arguments, the utilitarian approach in the past was supported by policy objectives and allegations such as "industrial progress is desirable, inventions is a necessary condition of industrial progress, not enough inventions will be made or used unless effective incentives are provided" (Machlup and Penrose 1950). It is based on the economic theory of public goods (Samuelson 1954): rather than focus on the creator, its primary concern is the community as a whole, and it aims to improve the allocation of resources to maximize the benefits of society through the analysis of economic welfare.

Greenhalgh and Rogers (2010) affirmed that "if a firm cannot charge all the beneficiaries of its innovation, then there is a problem of matching incentives to the value of the activity, which may lead to an undersupply of innovation." In economics, this is commonly referred to as market failure. In the case of the allocation of benefits related to the production of knowledge, market failure may occur when knowledge is either described as a pure public good or as a private good with positive externalities.

2.1.2 The economics of intellectual property

2.1.2.1 Knowledge as a public good

According to Arrow (1962) and Stiglitz (1999), free of any artificial construct, knowledge is both non-rivalrous and non-excludable, thus making it a public good. Public goods are those "which all enjoy in common in the sense that each individual’s consumption of such a good leads to no subtractions from any other individual’s consumption of that good" (Samuelson 1954).

A non-rival good in consumption means that the consumption of the good \(x\) by an individual \(A\) does not preclude the consumption of the same good of another individual \(B\), thus making the marginal cost of consumption equals to zero. Common examples of public goods are sunlight, radio transmission, public roads, and national defense. Public goods are often defined in contrast to private goods, which are those goods \(y\) whose consumption from an individual \(A\) precludes the usage of another individual \(B\), such as food, energy, or drinkable water. For example, an apple is a private good because if person \(A\) eats it, it prevents the usage of person \(B\). Conversely, sunlight is non-rivalrous because both \(A\) and \(B\) can enjoy it without precluding the other from consuming it. When treated as a public good, knowledge has often been assimilated with information (Archibugi and Filippetti 2015). When somebody consumes information, it does not reduce the quantity available to other individuals, making it non-rivalrous. While knowledge may be costly to produce, the marginal cost of sharing information with an additional individual is zero (Lévêque and Ménière 2004). For example, there is a zero cost of providing the notion of a mathematical theorem to an additional individual. However, as pointed out by Greenhalgh and Rogers (2010), while the use of knowledge from one actor does not prevent other actors from using it, its diffusion may exhaust the profits that can be obtained from it14. While information in itself is non-rival, the value associated with it can be rivalrous.

The other fundamental characteristic of public goods is that they are non-excludable, which means it is challenging (if not impossible) to exclude a potential consumer from using them. Recalling the previous examples, while it is relatively straightforward for \(A\) to prevent \(B\) from eating his apple, it is almost impossible for \(A\) to prevent \(B\) from enjoying the sunlight.

Several methods were used to prevent access to knowledge in the past: Archibugi and Filippetti (2015) list three of them: secrecy, access codes, and IPRs. The first method, secrecy, is widely diffused both in the military and business sectors. It relies on the underlying assumption that the best way to ensure the appropriability of the economic returns of knowledge is to prevent its diffusion. However, secrecy provides only partial protection. Practices such as headhunting, espionage, and reverse engineering can circumvent business and governmental agencies’ security measures and undermine their efforts. Moreover, since secrecy guarantees appropriability by impeding information diffusion, it has the downside of hindering the possibility for third parties to engage in cumulative innovation and encourage the duplication of R&D expense, reducing the overall economic welfare. Access codes are instead technological tools that prevent the unwanted diffusion of knowledge. While they increase the difficulty of access, they do not provide total protection. A single breach in the defense systems of businesses and governmental agencies, coupled with the non-rival nature of knowledge, may idle their protective measures. Finally, IPRs are a family of legal instruments that, with specific limitations, allow their owner to exclude other individuals from enjoying the benefits of the knowledge they safeguard.

When a good is both rival and excludable, it is generally considered a private good. In opposition, when it is both non-rival and non-excludable, it is usually considered a public good. However, there are also other dimensions, such as when products are non-rivalrous but excludable or when they are rivalrous but non-excludable. The former are generally referred to as club (or network) goods while the latter are referred to as common goods (Archibugi and Filippetti 2015). A typical example of a club good is on-line streaming services. While the consumption by one individual of streaming services such as Netflix or Disney+ does not prevent other individuals from enjoying them, they are potentially excludable by imposing a paywall that restricts access to those paying a monthly subscription. On the other hand, examples of common goods are ocean fisheries and forestry. While the consumption of fish in the ocean or wood in forests is rivalrous because excessive fishing or deforestation can deplete resources, it is challenging to restrict access.

| Rivalrous | Non-rivalrous | |

|---|---|---|

| Excludable | Private goods | Club goods |

| Non-excludable | Common goods | Public goods |

2.1.2.2 Knowledge as a private good with positive externalities

Opposed to Arrow (1962) and Stiglitz (1999), modern economics of science and innovation considers in his analysis the highly differentiated forms of knowledge. This perspective rejects the comparison between information and knowledge (Pavitt 1987) because, depending on the specific traits of the knowledge transferred, the consumer may experience high transaction costs, undermining the assumption that all knowledge can be considered a public good. Callon (1994) distinguishes between freely available knowledge and knowledge that can be used without incurring costs underlined that, except for few specific cases (such as consuming a drug or using a computer program with an already known interface), the acquisition of knowledge requires additional efforts from the consumer (such as learning time or other resources). Later, Stiglitz (1999) dismissed this aspect, affirming that Arrow (1962)’s definition of public goods does not consider the consumer perspective but only the producer’s. However, if we include in the definition of public goods also the transaction costs bore by the consumers, knowledge may be considered either a public or a private good based on the specific kind of knowledge we examine. As formulated by Archibugi and Filippetti (2015), "what makes knowledge different from public goods is not the related production process, rather its process of diffusion, which has been scarcely addressed in standard economic theory."

The heterogeneous dimension of knowledge may influence the positioning of knowledge as a private or public good (Nelson 1959). While basic research can be assimilated to a public good because it is possible to apply it in many different areas, knowledge regarding innovation in a product or a process directly applicable in the market can be assimilated to a private good with positive externalities (Greenhalgh and Rogers 2010). Positive externalities arise when a producer’s behaviors enhance other firms’ profits, leading to a misallocation of benefits.

The traditional economic argument in favor of IPRs is that, without a mechanism of appropriation for intellectual work, sometimes creators will not have any incentive to innovate and produce knowledge, potentially leading to its sub-optimal provision. Coase (1960) suggested that this could be solved by introducing clear and defined property rights. Positive externalities could be compensated by requiring a fee from the beneficiaries, and negative externalities could be offset by charging a tax to the responsible. In the absence of appropriate incentives for innovation, then IPRs represents a way to ensure the appropriability of the benefits raised by the innovation process.

2.1.3 The traditional economic model for IPRs introduction

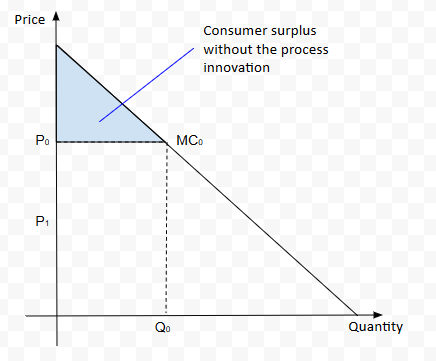

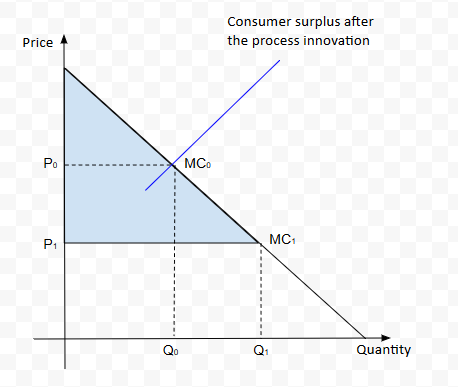

Imagine a perfectly competitive market composed of a large number of firms that produce a standardized product. The price \(P_{0}\) is equal to the marginal cost of production (\(P_{0} = MC_{0}\)). In perfect competition, economic welfare is entirely comprised of consumer surplus, while producer surplus is equal to zero. When a process innovation is introduced, it reduces the marginal cost of production from \(MC_{0}\) to \(MC_{1}\). If we consider knowledge as a non-excludable good, and the innovation can immediately be applied to the production process by all firms in the market, the increase in economic welfare involves only consumer surplus. In contrast, producer surplus remains equal to zero.

This may lead to the conclusion that, in the absence of an appropriability mechanism, producers have no economic incentive for innovation. The introduction of temporary monopolistic rights over the produced knowledge (such as IPRs), when assigned to innovators, aims to provide this economic incentive.

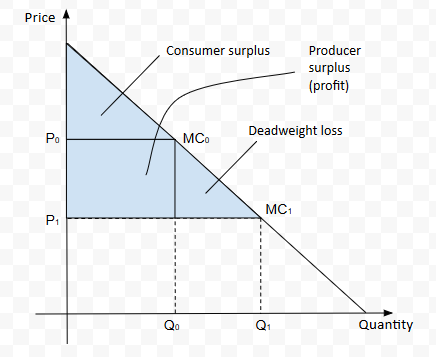

If we add IPRs to the model, its owner is the only individual that can benefit from the cost reduction created by innovation, either through direct application in the production process or by licensing it to other firms. Therefore, during the protected period, the price will remain \(P_{0}\), while the marginal cost of production for the innovator will decrease from \(MC_{0}\) to \(MC_{1}\). The consumer surplus will remain stable, and the innovating firm will enjoy a profit equal to \((P_{0}-P_{1})Q_{0}\). However, the market will also experience a deadweight loss equal to

\[DW = \frac{(P_0 - P_1)(Q_1 - Q_0)}{2}\]

where \(Q_1\) is the quantity of the good that would have been produced without IPRs. While the economic welfare is higher than in the scenario without the process innovation, it is still lower than without IPRs, meaning that it is not Pareto efficient. However, after protection expires, the producer surplus is zeroed, and consumer surplus is maximized, leading to Pareto efficiency.

Before the innovation

After the innovation

Economic welfare after the introduction of IPRs

Assuming that, in the absence of IPRs, no innovation would have taken place, while no protection mechanism provides static efficiency, IPRs encourage the system’s dynamic efficiency. The economics of IPRs aims to balance the dynamic efficiency of continuous innovation and the static efficiency given by the absence of IPRs.

2.1.4 IPRs in an oligopolistic market

The trade-off between static and dynamic efficiency is sometimes solved using competition economics. However, given that dynamic efficiency is impossible to measure with a satisfactory degree of precision (Drexl 2010), many economists of the neo-Schumpeterian school favor caution in applying competition law to IPRs’ design, referring to Schumpeter’s argument of creative destruction. According to Schumpeter, capitalism is an evolutionary process that is driven by "new consumers’ goods, the new methods of production or transportation, the new markets, the new forms of industrial organization that capitalist enterprise creates" (Schumpeter 1942).

Schumpeter (1942) affirms that it would be a mistake to evaluate oligopolistic structures without considering the evolutionary dimensions of the capitalist process. In particular, he identified innovation as a constant source of competition, explaining how even established oligopolies can be disrupted and countered by new forms of organization and technological revolutions. Additionally, Schumpeter (1942) examined the relations between IPRs and competition, affirming that competition policy should consider the positive effects of temporary monopolies to drive innovation and the creative destruction process activated by new technologies. He does not deny that, in some cases, competition policies are necessary to dismantle cartels that are effectively damaging the system but that drafting precise and effective policies is very difficult and should be done only on a case-by-case basis.

Economists advocating for neo-Schumpeterian approaches base their claims on the argument that monopoly power is necessary to enhance innovation and dynamic efficiency because monopolies’ profit is needed for investments in future innovation (Drexl 2010). So, even when IP confers monopoly power, the latter should be protected against state intervention because doing otherwise would reduce the innovation system’s effectiveness. Competition policy should not collide with the allocation of IP rights because the long term effects of these interventions are challenging to quantify, and on a theoretical basis, it is never recommended to interfere with the distribution of the benefits of IPRs. "When considering whether forcing the disclosure of companies’ trade secrets or compelling them to license valuable IP, policymakers must therefore balance the gains from stimulating short-term competition with the losses from the reduced investment in innovation. They should keep in mind, however, that while the allocative efficiencies that arise in the short term as a result of intervention are relatively easy to measure, the long-term costs of such actions are uncertain and difficult to quantify." (Geradin et al. 2006) A counterargument to the neo-Schumpeterian approach was already pointed out by Arrow (1962), which framed the applicability of Schumpeter (1934)’s line of reasoning in terms of incentives to innovate. In an oligopolistic market, a firm is already making a profit, and innovation only offers a higher revenue. However, when compared to a second firm contemplating market entry, the incumbent’s marginal gain15 is lower than the one of the potential entrant. This argument leads to the conclusion that an oligopolistic system, in the absence of new entrants, is less conductive to innovation. However, as pointed out by Lévêque and Ménière (2004), "this reasoning ignores competition between companies to conquer markets. The incentives are different if the monopoly knows that a competitor can enter its market by inventing and patenting a less expensive process or a similar new product." When firms compete for conquering a market, a race towards innovation is very likely to happen. Competition in the market is then replaced by competition for the market (Geradin et al. 2006). If the incumbent fails, it will lose the profit provided by the monopoly and the R&D investments, while if the entrant misses the window, it will only suffer the loss of the development costs. In this case, the monopolist has a higher incentive to innovate, even if it will never introduce into the market the innovative product.

Summing up, competition law is a useful instrument to leave access to a market open by forcing oligopolies and new entrants to compete with each other and, coupled with compulsory licenses, promotes the diffusion of knowledge in the market. Simultaneously, even if IPRs create static inefficiencies due to their monopolistic nature, in many cases they maintain the incentives for the production of innovation high, promoting dynamic efficiency, and discouraging the sub-optimal provision of innovation. However, such cases are not as frequent as one may think and that must be carefully evaluated on a case-by-case basis. As it was already mentioned, other incentives, economic or not, may already be in place. IPRs can alter these fragile dynamics, potentially hindering innovation, as it is claimed by Brüggemann et al. (2015) in the case of sequential innovation.

2.2 Three IPRs involving AI technologies: patents, copyright, and database

An in-depth analysis of the legal and economic features of all of them would go beyond the scope of this dissertation, thus I will focus on the main IPRs concerning AI technologies: patents, copyright, and the database sui-generis right.

2.2.1 Patents

2.2.1.1 Legal overview

Patents are a legal instrument that allows the patent owner to establish a temporary monopoly over particular uses of a patented invention. According to Guellec and La Potterie (2007), a patent confers on its owner the exclusive right to prevent third parties to make, use, offer for sale, sell or import a patented product or the product resulting from a patented process. Patents only offer protection on a national level, requiring the patentees to individually seek protection in each of the countries where one desires to protect the intangible asset. To minimize legal fragmentation and reduce transaction costs, patent legislation has progressively harmonized at a global scale by several international treaties (Charnovitz 1998).

In 1883 the Paris Convention for the Protection of Industrial Property was signed. It introduced two main provisions: national treatment and the right of priority. National treatment is a standard principle in international law that consists of providing to foreigners the same rights that it grants to its citizens, in our case, the ones concerning industrial property protection. The right of priority consists of conceding to the first applicant of a patent the exclusive right to extend it to other countries for twelve months. Before the Paris Convention, to ensure protection over his invention, the applicant had to file a patent in all states at the same time, creating several logistical issues (WIPO 2004).

The second significant development in the international harmonization of patent systems was the implementation of the Patent Cooperation Treaty (PCT), signed in 1970 and entered into force in 1978, which created an international procedure for patent application. While the examination and grant of a patent remained a responsibility of the national offices, the PCT allowed inventors to file a single application stating a list of countries where he/she desired to obtain protection, and it provided additional 18 months of priority.

In 1994, the signature of the Trade-Related Intellectual Property Agreements (TRIPs) introduced the most favored nation principle, a standard duration of patents, a standard definition of patentable subject matter, compulsory licensing, and extended patent protection to test data in agricultural and pharmaceutical products (Park 2008). The TRIPs agreement represent the last development in international patent legislation and determine the minimum requirements for patenting. Article 27(1) of Annex 1C recites that: "patents shall be available for any inventions, whether products or processes, in all fields of technology, provided that they are new, involve an inventive step and are capable of industrial application." Additionally, all jurisdictions exclude from patenting artistic creations, scientific discoveries, mental acts, abstract ideas, animal and vegetal varieties, methods for medical treatment, and medical diagnosis. To this day, the patentability of business methods, software, and biotechnological products depends on the specific provision of national legislation. While in the US it is possible to patent business methods and software, in most European countries it is not (Wells 2001).

2.2.1.1.1 Industrial application

The industrial applicability criterion has been introduced to guarantee the practical utility of granting monopoly rights to the inventor. In this case, industry should be interpreted broadly, with the meaning that the invention must be applicable for practical purposes (WIPO 2004). The economic rationale is to prevent the patenting of basic upstream applications that could slow down the development of commercially viable downstream applications, potentially reducing the net social benefit of society (Guellec and La Potterie 2007).

2.2.1.1.2 Novelty

Novelty is an unquestionable requirement for patenting: an invention is new when the prior art has not anticipated it. Prior art is defined as "all the knowledge that existed prior to the relevant filing or priority date of a patent application, whether it existed by way of written or oral disclosure" (WIPO 2004). The economic rationale at the basis of novelty is at the core of the utilitarian justification for IPRs. Since the introduction of an excludability mechanism involves a decrease in the static efficiency of the system to promote dynamic efficiency an innovation, there would be no reason to grant temporary monopoly rights for an invention that has already taken place (Guellec and La Potterie 2007).

2.2.1.1.3 Inventive step

A third criterion shall be respected: inventive step16. According to Art. 56 of the European Patent Convention, "an invention shall be considered as involving an inventive step if, having regard to the state of the art, it is not obvious to a person skilled in the art." Given that an invention has industrial applicability and it is novel, why then require an inventive step? Again, the norm is based on economic considerations (Guellec and La Potterie 2007):

promote competition: small and incremental innovation is part of the routine of many industries. Allowing a firm to patent a marginal improvement on a product or a process would prevent the competing businesses to innovate and would increase the probability of the development of permanent monopolies, hurting market competition;

reduce uncertainty: requiring a low inventive step increases the risk of granting patents that are not novel, increasing the probability of raising society’s costs without any benefit in the long-term. A high inventive step overcomes this issue and incentivizes radical innovation over marginal improvement;

ensure sufficient protection to inventors: an inventive step which is too low reduces inventors’ incentives because marginal improvements could immediately overtake any invention, dissolving the economic reward.

These three economic rationales have been included in models by O’Donoghue (1998) and Hunt (2004), who analyzed the impact of the size of the inventive step on innovation. According to their findings, a low inventive step reduces the lifetime of patents since patented marginal improvements would overtake them without risking of infringing them and incentivize investments in small, low-cost, marginal inventions while discouraging large and high-cost ones. On the other hand, a high inventive step increases the length of monopoly and the economic profits for a patented invention, while discouraging marginal improvements. Guellec and La Potterie (2007) argue that determining the optimal length of the inventive step is not trivial and largely depends on the technological field of the innovation. They affirm that small inventions are valuable for customers and that since, in many cases, significant innovations are the product of marginal improvements, preventing patentability would incentivize secrecy and reduce economic welfare.

2.2.1.2 Economic rationale and optimal patent design

Adopting an economic approach to patents allows us to evaluate IPRs from an efficiency-based perspective, where their introduction is justified only if they encourage innovation and the diffusion of technology while minimizing the deadweight loss associated with the temporary introduction of monopoly rights (Langinier and Moschini 2002). The net social benefit of an innovation is positive when the welfare it brings to society exceeds the cost required for its production. On the other hand, the net individual benefit of an innovation is positive when the innovator’s returns are higher than the R&D cost he incurred during production. The underlying economic logic behind the patent system is to find a way to ensure that, when the net social benefit is \(\geq0\) and the net individual benefit is \(\leq 0\), the innovation is produced anyway. Only when the trade-off between the net social benefit and the individual benefit is positive, a patent should be granted (Lévêque and Ménière 2004). Providing a temporary monopoly right over the benefits of the invention was the historically chosen solution to this issue.

Many patent advocates affirm that, by ensuring high profits for the inventor, the disclosure of knowledge that would otherwise have remained secret and the creation of a market of tradeable assets would be encouraged, thus leading to the optimal allocation of productive resources (Guellec and La Potterie 2007). Unfortunately, this is rarely the case. The introduction of a patent involves two possible scenarios: the invention would have taken place even without the incentive provided by a temporary monopolistic right, or it would not. In the first case, from an economic perspective, the patent system should be structured in such a way that it is not possible to patent the innovation. However, determining that would require to evaluate factors such as the R&D costs of the invention, the risk of the research, the existence of alternative appropriability mechanisms for its returns, and the possibility of obtaining it through publicly-sponsored research. Generalizing, only if the invention is costly, risky, there is no other way of protecting it, and it is outside the interest of government-funded research, a patent should be introduced. Unfortunately, this identification process is costly, complex and largely depends on information that may be known only to the patent applicant, that has no interest in sharing it with patenting authorities, since it may result with having its patent application rejected.

Patents are an exclusionary tool that can potentially hinder innovation, thus betraying their original purpose: when a general-purpose invention is patented, it provides the holder with a strong market power that could prevent diffusion, follow-up research, and increasing the deadweight loss (O’Donoghue 1998). This was the case of the patent granted to George Selden in 1895 for the invention of the automobile (Howells and Katznelson 2016). Selden’s application included the combination of an internal combustion engine in a 4-wheeled car. Selden’s claim was very general and did not specify critical details regarding the engine. In 1899 he teamed-up with William Whitney and started collecting royalties from other automobile manufacturers up until Henry Ford and other four car makers challenged the patent in 1904. In 1911, Selden’s patent was declared invalid by the appeal court. Merges (2009) suggests that Selden’s rent-seeking behavior may have prevented access to the automobile market to small firms, discouraging follow-up research, and potentially impeding innovation. Another famous patent that arguably impeded innovation was the one granted to the Wright brothers, who made a modest improvement to flight technology and secured a patent in 1906. Later they engaged in a fierce legal battle to monopolize the US airplane industry, imposing prohibitive fees for economic gain (Boldrin and Levine 2013) and effectively hindering follow-up innovation. When the US entered World War I, the US military did not have a competitive airplane industry, and the lawsuit was only solved through political channels by effectively absorbing the Wright patent in a patent pool composed by the other airplane producers (Shulman 2003). On the other hand, the establishment of clear property rights facilitates the commercialization of the invention, ensuring the appropriability of returns (Coase 1960). Many research institutes do not have the infrastructures needed to reach downstream users, and IPRs ease the transfer of these assets to industry actors through a license (Guellec and La Potterie 2007).

Moreover, in the absence of a patent system, disclosure rely on the willingness of the original inventor and the nature of the invention. While for product innovations there may be other systems of appropriability of the economic returns such as first-mover advantages or scale economies, in process innovations the most common alternative to patenting is secrecy. Therefore, in some cases, patents may favor the disclosure of process innovations and reduce the risk of the multiplication of R&D efforts (Archibugi and Filippetti 2015).

"Applying this series of tests to individual patent applications or to entire categories (e.g. technical fields) would make the patent system of high quality from an economic point of view" (Guellec and La Potterie 2007). Unfortunately, applying these criteria to patent applications is not straightforward. Sometimes disclosure and exclusivity are in contrast with each other since greater exposure would facilitate competing firms to "invent around" the patent, thus reducing the returns of the innovative firm. In other cases, the information required to evaluate the impact of an innovation is known only after years of market introduction or it is not measurable at all. Additionally, the design of an optimal patent system requires greater coordination with the authorities in charge of innovation policies and competition, well beyond the reach of patent offices. Evaluating the grant of a patent on a case-by-case basis would increase the application cost, and it would reduce legal certainty, raising the risks associated with unwanted infringement or of having the patent revoked (Guellec and La Potterie 2007). Since firms’ investments in R&D are made depending on the probability of covering costs and appropriating the returns for profit, increased uncertainty in the evaluation process has negative effects on both competition and investment, amplifying business risk and raising the costs of innovation. Some institutions even explicitly exclude the use of economic considerations for patent evaluation, such as the European Patent Office. "The EPO has not been vested with the task of taking into account the economic effects of the grant of patents in specific areas of technology and of restricting the field of patentable subject matter accordingly" (European Patent Office 2019).

2.2.1.2.1 Patent breadth

Patent breadth (or scope) measures the use that the innovator can make of the patent compared to his competitors (Lévêque and Ménière 2004). It is not determined by law but results from the combination of the number and genericity of novelty claims and the inventive step. Patent offices identify what an inventor has found or not based on the claims present in the patent application but the definitive scope is determined in court during a case of alleged infringement17.

According to economic theory, the scope of a patent can be divided into lagging breadth and leading breadth. Lagging breadth affects horizontal competition, determining how far competitors should position their products in order not to infringe. Klemperer (1990) frames it as the maximal degree of substitutability between the patented invention and a competing one while Tandon (1982) defines it as the cost of inventing a substitutable product. In both scenarios, the competing products do not infringe on the patent, and the lagging breadth determines how much competition its owner will face. Taking Klemperer (1990)’s perspective, a broader scope decreases the substitutability degree of competing products, giving the patent owner higher market power, while taking Tandon (1982)’s one, it results in a higher entry barrier to the market and, therefore, weaker competition. Conversely, leading breadth affects vertical competition, which is the length of the inventive step needed in downstream research in order not to infringe the patent. It generally arises in the context of cumulative innovation (Guellec and La Potterie 2007), where an invention is needed for another one to happen.18 In a two-stages development scenario, where two different research entities contribute to innovation and the revenue is generated in the downstream sector, leading breadth determines how the profit be shared between them. "Granting too narrow a patent at one stage will reduce the negotiating power of the inventors at that stage as opposed to the inventors of the other stage, lowering their reward and, therefore, their incentive to invent in the first place, possibly blocking the innovative chain. Conversely, too broad a patent might lead inventors to require too high a share of the total reward, at the expense of other inventors, who might then choose to keep out, also breaking the chain" (Guellec and La Potterie 2007).

Summing up, an increased lagging breadth reduces the possibility of competitors entering the market and offering similar products, while a higher leading breadth makes it more difficult for competing innovators to patent marginal innovations based on the first patent (Scotchmer 2004). Balancing out leading and lagging breadth is not trivial and economists suggest three main approaches.

The first approach advocates for the creation of deep patents that cover all innovations that follow an initial discovery. Kitch (1977) proposes that deep patents allow the inventor to organize research efficiently, discouraging patent races and excessive investments. Other firms can then identify new applications and propose them to the patent owner and request a license or offering research partnerships as they would represent a new flow of revenue. However, these arguments are highly controversial. High uncertainty and asymmetrical knowledge may increase the complexity of the negotiations (and therefore transaction costs), since no party may be willing to share valuable information regarding the specifics of their invention for fear of imitation. Broad upstream patents may affect the early disclosure of fundamental innovations, incentivizing secrecy and preventing other researchers from investigating other applications of the invention (Matutes, Regibeau, and Rockett 1996). These rent-seeking behaviors may lead to patent races: firms may compete to be the first one to breakthrough and appropriate the totality of the revenues of the invention. Additionally, in many fields of research, the issue is not over-investment, rather under-investment. Even if the problem were over-investment, promoting broad upstream patents would not solve it but rather move it from the downstream to the upstream stage, reducing the profitability of downstream research and therefore risking an under-provision in that sector.

A second approach has been taken in the field of software. While computer programs as such are excluded from patenting19, it is still possible to patent software applications which use a mathematical formula in a specific way for a particular purpose. This resulted in the incentivization of extremely narrow patents, which constitute prior art (Neuhäusler and Frietsch 2019), incentivizing sequential innovation.

The third approach involves not applying intellectual property at all when innovations are cumulative, imposing the same non-patentability conditions as a requirement for licensing. Innovators directly compete with each other in the market, having a lower incentive to invest in R&D but having the possibility to draw from all existing innovations, reducing the costs derived from licenses, and eliminating the risks associated with possible infringement (Bessen and Maskin 2009). This is another common approach used in the software industry, promoted by the open-source movement. In copyright legislation it is referred to as copyleft, while in patent legislation is referred to as patentleft (Dusollier 2007).

2.2.1.2.2 Patent duration

TRIPs agreements fixed the maximum duration of a patent at 20 years from filing, making it almost uniform all over the world. Limiting the temporal length of protection is the easiest way for legislators to control the monopoly rights given to innovators. A longer duration would grant additional profits to innovators, and therefore it would increase their economic incentives. On the other hand, from an economic perspective, protection should be eliminated as soon as the innovator as received a reward equals to the profit it would have obtained if he invested the same amount of resources elsewhere, such as in bank deposit. In this framework, the discount rate is the first limit on the efficiency of long patents: the more distant in time the expected profit from the innovation, the less able it is to compete with the cumulative interest that a bank account would generate (Scotchmer 2004). Another reason for limiting the duration of patent protection are transaction costs (Langinier and Moschini 2002). Among time, subsequent inventions dilute the contributions to the technology provided by each inventor, and establishing the participation of an inventor to the new knowledge becomes more and more expensive as technology evolves (Lévêque and Ménière 2004).

Having determined that limited duration is essential for patents, how long should protection last? In other words, how is it possible to balance out the dynamic efficiency of a patent? Nordhaus (1969a) developed a model to determine optimal duration that minimizes the discounted value of the deadweight loss generated by the patent over its entire life under the constraint that the discounted profit of the innovator exceeds his R&D expenses. He affirms that duration and the scope of patents should depend on the particular characteristics of the reference market since different products and processes may have different optimal extents of protection. Thus the optimal solution would be to grant different protection lengths to innovations in different sectors, based on the cost of the invention and the shape of the deadweight loss as a function of price and time. Unfortunately, the current patent system establishes a standard maximum length to all patents, even if the R&D expenses greatly vary between different sectors. While there is a renewal system based on fees (De Rassenfosse and Pottelsberghe de la Potterie 2013), in which, periodically, firms can choose to extend the duration of protection, the deadweight loss imposed by a patent may still be higher than the benefit to society. The profits derived from a patent may be higher than the renewal fees even after the complete recovery of the R&D costs, thus blocking the diffusion of socially valuable inventions and encourage rent-seeking behavior, undermining the efficiency of the system.

To determine the optimal patent design, different combinations of length and scope can be used. The same economic reward could be obtained by either increasing the scope or the length of protection. Different approaches have been taken to strike a balance, notably by Tandon (1982), Gilbert and Shapiro (1990), and Gallini (1992). According to Tandon (1982) and Gilbert and Shapiro (1990), the optimal combination of duration and scope largely depends on the elasticity of demand, which influences the impact of price on the deadweight loss. Patent protection is framed as the power it confers on the market. Following this understanding, a broad patent reinforces the monopoly of the innovator by excluding from the market products that are substitutes for it but that are substantially different. So, if the product elasticity is high, deadweight loss increases faster with breadth than with length, leading to the conclusion that narrow and long patents are preferable. Conversely, when the product is highly inelastic, deadweight loss increases faster with duration than with breadth, making short and broad patents more desirable. A different approach was taken by Gallini (1992), which instead took into consideration the effect of patent breadth on competition. She defined breadth as the R&D costs of imitation of an innovation without infringing its patent. Patents are framed as the conditions under which the innovator shares the market. "The longer the patent, the more incentive imitators have to invest in the creation of alternative technologies. By contrast, a broad patent makes it costly for imitators to enter the market. In other words, a long patent attracts imitators by giving them the time to recover the cost of their imitation, whereas a broad patent dissuades imitators by increasing the cost of imitation." (Gallini 1992) However, the R&D expenditure undertaken by imitators is wasted because the patent technology has already been developed. Because of these considerations, she concluded that short and broad patents are preferable because it is better to have a strong monopoly for a short period than an oligopoly for a longer period coupled with worthless imitation costs.

2.2.2 Copyright

Copyright is a legal instrument used to protect "any literary, dramatic, musical or artistic original work, provided that is recorded, either in writing or otherwise" against imitation (Spence 2007). Contrary to patents, it only protects against the exact reproduction of the work and not independent creation. Copyright gives authors an exclusive right over the reproduction, performance, adaptation, and translation of their work. The criteria used to determine whether an intangible asset can be subject to copyright protection are very inclusive. Work is defined as any quantity of material assembled with some conscious ordering. There is no judgment of quality or contents in the definition of literary: originality does not require any inventive step, only an intellectual effort of some kind (Spence 2007). Additionally, copyright legislation also covers a range of related rights, which are rights of creative works not connected with the works’ authors. They include the rights of performers, phonogram producers, broadcasting organizations, and, within the European Union, the rights of film producers, database creators, semiconductors, and industrial design. Provided these general requirements, it is clear how the subject matter of copyright protection is extensive. It encompasses many industries, such as visual arts, publishing, performing arts, and, since the digital revolution, digital products such as software code and databases.

Civil law and common law regimes adopts two different approaches. In common-law copyright is understood solely as a set of economic rights that aim to guarantee the economic appropriability of the production of knowledge. They include the exclusive right for the reproduction, distribution, renting, lending, public performance, and making adaptations of the work, such as translating or dramatizing a literary work and transcribing or producing an altered version of a musical work (Spence 2007). On the contrary, in civil law regimes, other rights (commonly referred to as moral rights) such as paternity, false attribution, and integrity, are associated with the economic rights. The distinction between common law and civil law approaches to copyright is reflected even in terminology. While in the US and former Commonwealth countries, the legal term to define these IPRs is copyright, in civil law countries, more emphasis is put on the author figure, and therefore they are referred to as author’s rights (generally using the French term droits d’auteur).

Differently from patents, that have a registration system that requires the filing of an application to obtain protection, copyright does not have a registration system. Protection is granted since the act of creation of the work, and it is automatically awarded to the author (Spence 2007). However, sometimes the identification of the author is not so trivial as one may expect. According to VerSteeg (1995), an author is an individual who has actively created something copyrightable, as the writer, the photographer, or the composer.

From a historical perspective, the author is a legal figure born in XVII century England, in the context of the dispute Donaldson v. Becket. Donaldson was a Scottish bookseller whose business model consisted of reprinting classics of English literature. When he published James Thomson’s book "The Seasons," Becket and a group of London booksellers sued him for infringement, since they allegedly claimed they detained the copyright (Rose 1988). At the time, copyright in the United Kingdom was protected by the Statute of Anne (1709), which granted limited protection of fourteen years to books with a possible second term if the author was still living. The Statute was based on the Stationers’ Company regulations, a publishers’ association that regulated the printing of books in London. It introduced a temporal limit of protection and the possibility for authors to become copyright holders, effectively giving birth to the author as a legal figure. In England, copyright was a right created for publishers, responsible for the diffusion of literary works. While at the dawn of copyright legislation it was relatively easy to determine the author of a work, with the progressive expansion of copyright subject matter and complexity, it has become increasingly challenging to assign attribution. In the past, business models such as work-for-hire and technological innovations such as film-making questioned the traditional association of property rights with authorship, leading to the creation of models of attribution tailored to the specific issues. Today, AI-created works are putting these models again to the test.

2.2.2.1 Length

Copyright protection starts from the moment the work is created, and it proceeds until some time period after the author’s death. The ratio of this provision is to allow the author’s successors to benefit economically from the author’s work. In some legislation, moral rights continue in perpetuity. In the Berne Convention, the minimum duration of copyright protection is fixed at 50 years after the death of the author. However, more and more countries are extending the length of protection to 70 years, to harmonize with US and EU IP regimes. In some cases, specific categories of works (such as anonymous, cinematographic, and posthumous works) are awarded a different length of protection to minimize the deadweight loss to society. When copyright protection expires, works enter into the public domain and are freely accessible by everyone.

International copyright legislation is highly fragmented, and it is currently formed by an interlocking system of treaties formed by the Berne Convention for the Protection of Literary and Artistic Works of 1886, the Universal Copyright Conventions of 1952 and 1971 and the WIPO Copyright treaty of 1996. Additionally, neighboring rights are regulated by ad-hoc treaties such as the Rome, Geneva, and Brussels Conventions and the WIPO Performances and Phonograms Treaty. In 1994, the adoption of the TRIPs agreement contributed to the harmonization of international copyright law, but the global legal framework is still disjointed. Some countries have adopted all the latest multilateral treaties, while others abode only the minimum standard required by previous agreements (Goldstein 2001).

Compared to patents, which in almost all legislation have a standard limit of protection of 20 years from filing, copyright has an unusually long term of protection. The economic rationale is that the success of a work is highly uncertain, and it can come many years after the first edition. So, a long span of protection represents an additional guarantee for the author to obtain the profit from his work, even if it is delayed in time (Landes and Posner 2003; Diderot 1767). In this way, the creator’s lower profit in each period is compensated by a higher number of periods, to enable him to recover his cost and provide him with sufficient incentive (Landes and Posner 2003). On the other hand, the unusual length of copyright protection may have also arisen from the intense lobbying of interest groups in the show business industry. Initially set at 14 years, copyright in the US has been gradually extended to the current 70 years after the author’s death. While this unusual length may be partly justified in the context of literary works, with the expansion of the scope of copyright to works that are technology themselves, or essential inputs for the production process, such as software or databases, 70 years after the author’s death greatly increase the deadweight loss, suggesting that a revision may be needed for specific products.

2.2.2.2 Scope

Copyright protects the exact reproduction of the author’s works and not the act of using the ideas expressed, considered the building blocks of knowledge and fundamental for transmission. Word strings and music are protected, as other ordered strings of symbols such as software, but not algorithms. In the US legislation, the dichotomy between ideas and expression is solved by the doctrine of "comprehensive nonliteral similarity," (Mohler 1999) where the line between infringement and autonomous creation lies on the evaluation of mechanical changes are made, such as changing the names of the characters in a short story or renaming the variables in software.

Copyright protection is also subjected to several limitations. First of all, some categories of work might not be protected at all. International legislation requires that a work is fixed in a tangible form, and therefore non-registered works fall out of copyright protection. Additionally, some legislation explicitly exclude from protection works such as laws, court sentences, and administrative decisions (Goldstein 2001). Second, some forms of exploitation of a work that theoretically would require a license may be carried out without explicit permission. Article 9, par 2 of the Berne Convention affirms that reproduction rights may be granted, "in certain special cases, provided that such reproduction does not conflict with a normal exploitation of the work and does not unreasonably prejudice the legitimate interests of the author". Third, it is possible to grant compulsory licenses regarding certain individual cases, such as the mechanical reproduction of musical work and broadcasting. Similarly to patents, the author receives an economic compensation, but the amount is generally decided by a court or by the consumer (WIPO 2004).

The reason for these exceptions lies in economics. When a consumer gives a low but positive value to a work, and they are not willing to meet the cost of a transaction with the copyright holder, the diffusion of the work may be reduced to a sub-optimal level, diminishing the overall economic welfare (Landes and Posner 1989). To solve this problem, the US developed the fair use doctrine which, by analyzing the nature and the purpose of the usage of the work, determines whether a copyrighted work can be used without the permission of its author (Depoorter and Parisi 2002). The doctrine has no equivalent in Europe, but it is considered admissible in some national law regimes. Fair use exceptions generally include citations, news reporting, and use of the works for teaching purposes. Additionally, depending on the legislation, copyright protection may be limited by a range of defenses such as fair use for non-commercial purposes (private study and research), public interest, parody, review, and criticism.

2.2.3 Databases

The recent technological advancements and the development of a data-driven economy prompted many business and industries to push their government for the introduction of a new right for protecting the investments made in databases. Database production is a long and expensive process, but ordered and easily searchable data-sets are essential prerequisites for many information services, and the basis for ML-powered AI.

Potentially, databases could be covered by copyright, under the definition of literary work and in compliance with the Berne Convention. Additionally, article 5 of the WIPO Copyright Treaty (1996), states that “compilations of data or other material […] which by reason of the selection or arrangement of their contents constitute intellectual creations, are protected as such. […] This protection does not extend to the data or the material itself and without prejudice to any copyright subsisting in the data or material contained in the compilation”. However, copyright protection requires a creative effort and originality, and it is conceptually difficult to stretch these elements to databases. This opinion was first expressed with the sentence of the US Supreme Court in the case Feist v. Rural Telephone Service Company in 1991. Rural was a public utility providing telephone services to various communities in Kansas and published databases of telephone address. Feist extracted information from the database in question, and Rural accused them of being in infringement. The US supreme court sentenced that the database was not eligible for copyright protection because it lacked the requirement of originality, and its creation did not involve any creative effort, rather the opposite: the intellectual capital of databases depends on completeness, ease of access, and the standardized categorization of information. Databases are hardly created from scratch. On the contrary, they draw information from preexisting databases and other sources of data. On the other hand, applying copyright legislation to databases has raised more than one eyebrow: given the particular nature of the subject matter, applying the entire length of copyright protection to databases could potentially lead to a disproportionately higher welfare loss.

Still, a part of the database industry lamented the absence of a system of protection for uncopyrightable databases as a potential cause of market failure, where free-rider competitors who contributed nothing to the data collection could appropriate the returns of the producer’s investments. Therefore, starting from the 1960s, some European states created a series of legislative instruments to protect databases that fell outside the scope of copyright protection. Since legal discrepancies between the EU Member States could potentially harm the free-flowing of goods within the Digital Single Market (DSM), in in 1992 the European Commission drafted a proposal for a Directive on the Legal Protection of Databases that introduced a sui-generis right for databases, and was later amended and entered into force in 1996. The Directive was not self-executable, and it needed the implementation law by the Parliaments of the Member States. While within the EU, the harmonization was concluded in 1998, at the international level the reciprocal character of the Directive has created pressures for the acceptance of the EU model of database protection.

2.2.3.1 The European Directive on databases

Article 1(2) defines a database as “a collection of works, data or other independent materials arranged in a systematic or methodical way and capable of being accessed by electronic or other means.” The directive excludes “computer programs used in the manufacture or operation of databases which can be accessed by electronic means.”

In Art.3(1), the Directive distinguishes two different scenarios for a database. When the database already enjoys copyright protection, since the creative effort required for its creation makes it eligible for copyright protection and when it does not. When the database enjoys copyright protection, the Directive provides the author the standard copyright legislation, depending on how Member states structured the national law of application. Still, this provision cannot unreasonably prejudice the rightholder’s legitimate interests or conflicts with the normal exploitation of the database. When a database does not enjoy copyright protection, it falls within the scope of the sui-generis right, that is the novel element of the European Directive, conditioned to the ability of the compiler of demonstrating that there has been a “qualitatively and/or quantitatively substantial investment in either the obtaining, verification or presentation of the content to prevent extraction and/or re-utilization of the whole or of a substantial part, evaluated qualitatively and/or quantitatively, of the contents of that database.”

Extraction and re-utilization are precisely defined in the Directive. The former is defined as “the permanent or temporary transfer of all or a substantial part of the contents of a database to another medium by any means or in any form,” while the latter is “any form of making available to the public all or a substantial part of the contents of a database by the distribution of copies, by renting, or by other forms of transmission, including on-line.” This rule grants protection to the producer of a database, irrespective of the database’s eligibility for copyright or other protections. However, actions concerning the non-substantial part of a database are non-infringing, and the sui-generis right is limited by first-sale exhaustion. Public lending is expressly excluded from the scope of protection. The national law of application determines additional exceptions.

The protection accorded through the sui-generis right is granted for fifteen years, starting from the completion of the database. It is possible to renew the term of protection for another fifteen years if the database has been subjected to a substantial change that required a significant new investment. However, this creates issues concerning the incentive provided to database producers, since renewal creates an incentive to update the database even when there is no real need with the objective of extending protection (Koboldt 1996). Moreover, in the final draft of the Directive, the compulsory licensing for sole source databases originally proposed by the European Commission was deleted. Such a license would have made it possible in those instances where the stored information could not at all or not without great practical or financial difficulties be created or gathered independently (Grosheide 2002). From a purely economic perspective, however, the absence of a compulsory licensing scheme equals to granting an indefinitely long monopoly. Data can be kept reserved but used within the firm, providing a comparative advantage. Databases are essential for Artificial Intelligence systems, since machine learning, the game-changer in the field of AI, needs organized and ready-to-use data-sets to build effective predictive models. As a consequence, inefficiencies in economic welfare are created, increasing the deadweight loss caused by IPRs in the data economy.

2.3 AI and Intellectual Property Rights

2.3.1 Limits of IPRs legislation

Unfortunately, the review of the main economic arguments on the best structure for IP systems remains on a theoretical basis. Since its first developments in the XIV century, the legal framework that surrounds patents, and, in general, IPRs, has demonstrated a lack of flexibility that is in striking contrast with what it aims to protect, that is, technological innovation and creation. While economists such as Nordhaus (1969a) call for an increase in differentiation in the nature and degree of IP protection, based on industry and market needs, the fundamental economics of existing laws remain fixed on old assumptions and paradigms. This is because legal institutions evolve incrementally and are focused on preserving the integrity and consistency of rules, even when there is a dire need of radical transformations to remain faithful to the rationale and motivations that gave them birth in the first place (David 1993). When patents first appeared in the XIV century, they were designed to attract foreign inventions to boost development. They incentivized innovation in the sense that they promoted the dissemination of precious information in a national economy, encouraging its growth in the long run, but they were conceived as a preindustrial system of protection that served preindustrial or industrial needs. The development of a knowledge-based economy sharpened the possibility of information to act both as a capital and a consumer good, and has made evident that the patent system needs a revision, since the incentives to innovate have changed (as the success of models such as patentleft and copyleft demonstrated).

The fixed character of IP law has increased the level of uncertainty regarding the adaptation of IP law to new technologies (David 1993). While patents were designed to promote innovation, new technologies and economic structures have changed their role in the economy. Invention is often a cumulative process and the enforcement of patent rights can interfere with further discovery. Patent races and inventing-around strategies may deflect resources and incentivize rent-seeking behavior, while at the same time discouraging complementary inventions because previous patentees may be able to extract revenues in downstream innovation (David 1993). The current legal framework is far from being efficient and, in the meantime, new technologies keep on posing new challenges and requiring emergency adjustments to the new circumstances. In particular, AI technologies are posing critical challenges to the IP legal framework, while at the same time IPRs influence the structure and rate of innovation, introducing distortions in the market through the introduction of incentives or disincentives to innovators.

Recently legal scholars have started a lively debate on how to face the challenges presented by AI to the current legal system. However, as it was previously mentioned, the legal perspective is intrinsically limited. Recalling the utilitarian justification, IPRs should be introduced only when they contribute to the promotion of innovation. Thus, I argue that the introduction or modification of IPRs regimes needs to prioritize the economic effects of introducing new norms rather than continuity with previous legislation. As mentioned in section 1.1.1.3, policymakers should maximize the net social welfare when shaping the rule of property rights. This requires to strike a balance between incentives that stimulate innovation and the tendency of IPRs to create monopoly rights and dysfunctional effects.

In particular, the general statements concerning utilitarian perspective on IPRs need to be reassessed with the concrete case examined, in our case the AI market. Unfortunately, since creative and innovation markets related to AI function under unequal conditions, this is not an easy task, and, even if IPRs are required to stimulate investments in R&D, current regimes need to be re-calibrated to take into account both market and non-market considerations, favoring an increase in the differentiation of the scope and length of IPRs. For example, a key factor is the elasticity of product demand, as it was suggested in section 1.2.1.2.2 in relation to optimal patent design (Nordhaus 1969a). IPRs are not justified a priori: if in the market there are already sufficient incentives to promote R&D efforts, the introduction of monopolies on technology would only reduce society’s welfare, either through monopolies or by adding the administrative costs of the IP system. Hilty, Hoffmann, and Scheuerer (2020) explored various economic paradigms to justify the application of new IPRs to AI technologies: the general incentive theory, the investment protection theory, and the prospect theory.

2.3.2 General incentive theory

General incentive theory is the original argument of IPRs, that we examined in section 1.1.3. It suggests intellectual outputs would not be produced without the incentive provided by property rights. However, it would be short-sighted to affirm that economic rewards are exclusively tied to mechanisms of appropriation such as IPRs. In particular, as it was mentioned in section 1.1.4, maintaining a stable market position and/or accessing successful market opportunities may be determinant for a firm to invest in R&D. When we apply this theory to the AI market, there is no evidence of lack of motivation to invest in innovation, rather the opposite: AI-related innovation is thriving. While an under-provision in innovation in the AI field is still theoretically possible, this may likely be caused by other bottlenecks in the system, such as the scarcity of AI experts (McGowan and Corrado 2019) and data fragmentation (Martens 2018), issues that cannot be solved by using IPRs.

When we transpose this approach to the by-products of AI, legal scholars often claim that without gaining rights to the outputs of AI, developers have no sufficient incentives to create such AI systems in the first place (Abbott 2017). However, this does not take into account that there are different ways through which developers may limit the use of these systems, such as product-as-a-service (PaaS), in which the use of the AI system residing in cloud platforms can be controlled by limiting the number of API calls, the duration of the task and the amount of the processing power used. Another commonly used business model is typical of the platform economy, where developers may provide the opportunity to access to higher-quality, personalized AI systems in exchange for a periodic fee20. AI system developers can potentially never fully disclose the AI model to the end-user, thus making their work profitable without the need to claim ownership on AI by-products.

We can also observe that the AI market has also adopted a self-regulation model, where actors voluntary share their intangible assets (Gonzalez, Zimmermann, and Nagappan 2020) under various kind of licenses. This approach is typical of software industry, where many important demanders actively contributed and distributed open source projects as a source of complementary innovation (Wang, Chen, and Koo 2020), while individual programmers often collaborated for prestige or good-will, leading to a process where innovation feeds itself. To a lesser extent, we are assisting to a similar process in the context of the data market, with pleas of the liberation of data gathered by public administrations in standard, freely accessible formats (under the open data paradigm) that may lead to increases in innovation rate and economic competitiveness for private companies (Alderete 2020).

2.3.3 Investment protection theory

Investment protection theory focuses on the need to protect the investments made by the innovators by minimizing free-rider behavior (Hilty, Hoffmann, and Scheuerer 2020). It was modeled by Nordhaus (1969b), who applied this framework to technologies whose innovation processes are long and require high investments in markets with slow innovation cycles and high probability of imitation and misappropriation. This paradigm is extremely targeted to market scenarios where incentives to innovate are low, suggesting the introduction of IPRs as a way to increase them.

Although AI technologies require a certain degree of investments (such as high-quality data and computing power), it varies greatly depending on the specific application sector and scale of the industry. However, in most cases, AI innovation works through incremental progress which generally does not require high investment (Hilty, Hoffmann, and Scheuerer 2020). Even if imitation is possible, other systems of protection may already be in place, such as the database directive. Moreover, Teece (1986) affirmed that, in certain cases, investments may already be protected even when IPRs are not granted at all. Specifically, he suggested that, in some cases, such as when new products are difficult to copy, there is no need for state-provisioned protection. He made the case of cospecialized assets, whose value is tied by a bilateral relation between two goods: possessing one without the other is of no use. He affirmed that in the context of innovations whose value depend on cospecialized assets that can easily be kept secret, IPRs are of no use, since a mechanism of appropriability is already in place, thus making the introduction of IPRs detrimental to economic welfare. A typical example of cospecialized assets in AI technologies is characterized by algorithms and weights. While algorithms are often published in scientific papers, weights21 are generally kept secret (Hilty, Hoffmann, and Scheuerer 2020). An AI system without correlating weights would be valueless for potential free riders. Moreover, imitation through reverse engineering is possible only to a certain extent because of the black box effect of ML and, even when it is possible, it is often more costly than building an original AI system. This further reduces the incentive for imitation in favor of autonomous creation. As a consequence, it seems that the investments undertaken for developing AI systems are already sufficiently protected and that the introduction of IPRs on the basis of investment protection theory is not motivated by any economic justification.

Someone may suggest that this is only applicable to AI systems and not to the by-products of AI. However, the extent to which it may be reasonable to introduce additional IPRs to AI-aided products largely depends on the rate of innovation of the specific industry, which determines the rate of substitution of new products. The utility of AI outputs is strictly correlated to the time it takes for them to become obsolete. In other words, when AI-based innovation and creation surpass a certain threshold, the utility of each AI output reduces, as effect of incremental innovation, a situation where investment could not be recouped even with the introduction of IPRs22. A higher rate of innovation reduces the temporal difference between dynamic efficiency and static efficiency, making IPRs detrimental to economic welfare. The rate of innovation depends on the specific economic sector of the AI output, that cannot be determined before and can only be evaluated on a case-by-case basis (Hilty, Hoffmann, and Scheuerer 2020). So, while IP protection for AI outputs may potentially be justified under the investment protection theory, affirming that a completely new IP regime is needed for AI by-products is merely speculative and it may be counterproductive, since it would increase the legal costs associated with innovation. Considering that current legislation already provides the possibility to protect AI-aided outputs by mentioning a human as inventor or author23, there is no need to create new IPRs.

2.3.4 Prospect Theory

In section 1.2.1.2.1, I already presented the basis of prospect theory when referring to Kitch (1977)’s proposition for determining optimal patent breath (Kitch 1977). He suggested granting to the inventor short and broad patents to improve R&D coordination and reduce over-investment in innovation. In the context of AI technologies, over-investment may seem relevant, but it would also interfere with the ability of other innovation to conduct parallel R&D efforts, thus unnecessarily blocking the way of other innovators. This may subsequently lead to “races to create or invent, which may lead to wasteful duplication of research effort. Furthermore, instead of enabling the original inventor to coordinate efficiently the exploitation of the technology, a quasi-monopoly may lead to satisfying behaviour and thus to an inefficiently narrow focus on improvements related to the primary AI creator’s or inventor’s principal line of business” (Hilty, Hoffmann, and Scheuerer 2020). The introduction of IPRs may reduce the incentive to proceed with cumulative innovations and favor rent-seeking behavior. As we will see in chapter three, this is particularly relevant, since AI technologies are a General Purpose Technology, and enhancing the scope of protection on the basis of Kitch (1977)’s prospect theory is very likely to slow down or exacerbate virtuous cycle of complementary innovation, reducing economic welfare.

2.4 Conclusions

This chapter presented Intellectual Property Rights, a legal institution that has the declared goal to incentivize innovative behavior. First, the philosophical foundations for the creation of property rights on intellectual creations were presented, distinguishing between the natural rights arguments, the desert argument, and the utilitarian argument, and accepting the latter as the most reasonable one, since it is agnostic to the introduction of IPRs. The utilitarian argument accepts IPRs only to the extent to which they present benefit to society and it is based on economic analysis. Second, I analyzed three IPRs strictly involved with AI technologies: patents, copyright and database sui-generis right. The section was mainly focused on the economics of patents, the first IPR introduced in the economy, on which other IPRs, such as copyright, were modeled. Third, I applied the economic analysis of IPRs to AI technologies. In contrast to the legal literature on the relations between IPRs and AI, I observed that new IPRs would only be detrimental to economic welfare and innovation. I determined that the dynamic character of the AI market and the presence of alternative systems of appropriation already provide sufficient incentives to embark in innovative behavior. The introduction of additional IPRs specific of AI technologies would only represent a burden to the innovative process, potentially hindering innovation.

References

Abbott, Ryan. 2017. “Patenting the Output of Autonomously Inventive Machines.” Landslide 10 (1): 16–22.

Alderete, Maria Veronica. 2020. “Towards Measuring the Economic Impact of Open Data by Innovating and Doing Business.” International Journal of Innovation and Technology Management 17: 1–20.

Archibugi, Daniele, and Andrea Filippetti. 2015. “Knowledge as Global Public Good.” In The Handbook of Global Science, Technology and Innovation. Wiley, Oxford, 479–503. Wiley Online Library.